Home | Make a donation

Make a donation

With just 15 euros, you make it possible for a person with emotional distress, suicidal behavior or in a situation of unwanted loneliness to receive the emotional support they need.

I want to make a contribution and help you continue to provide emotional support.

Choose whether you want to make a one-time or recurring donation:

Amb la teva aportació, tots hi guanyem!

Gràcies a la reforma de la Llei de Mecenatge de 2024, ara donar a les organitzación socials té més avantatges. Per a les persones físiques., pots deduir-te els següents percentatges segons l’aportatció realitzada.

40%

DEDUCCIÓ

Per a donacions fins a 250 €

80%

DEDUCCIÓ

Per a donacions superiors als 250 €

153

Daily calls and conversations

408

Voluntary people

7

Emotional support services

56

Active years

Testamentary legacy

Any contribution counts and is very important to make our work possible. By including the Ajuda i Esperança Foundation in your will, you will help people who are experiencing critical situations: people who feel alone, are afraid, anxious or suffer from a mental illness.

You can make our telephone and chat services heirs, co-heirs or legatees of your estate at AJUDA Y ESPERANZA FOUNDATION NIF: R5800402I and address at Avda. Portal de l'Angel, 7 4º/Q 08002-BARCELONA and help us reach everyone who needs us.

Here we will resolve your doubts or help you with legal procedures, without any obligation.

collaborate Do it for you and for everyone.

The Foundation is and will be thanks to all the people who collaborate with us. Today for others, tomorrow it could be you who needs help. Empathy, altruism and the desire to share hope move the entire chain that ensures emotional well-being.

Tax benefits of donations 2025

This 2020, an increase in tax incentives for donations received in the "Law 49/2002, of December 23, on the fiscal regime of non-profit organizations and patronage incentives”. the deduction is increased by five percentage points with effect from January 1, 2020.

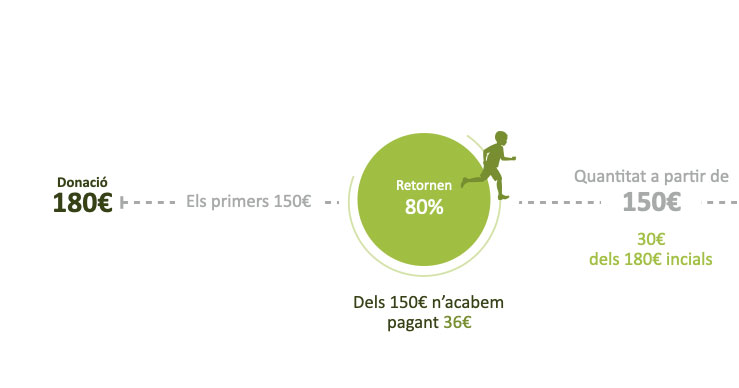

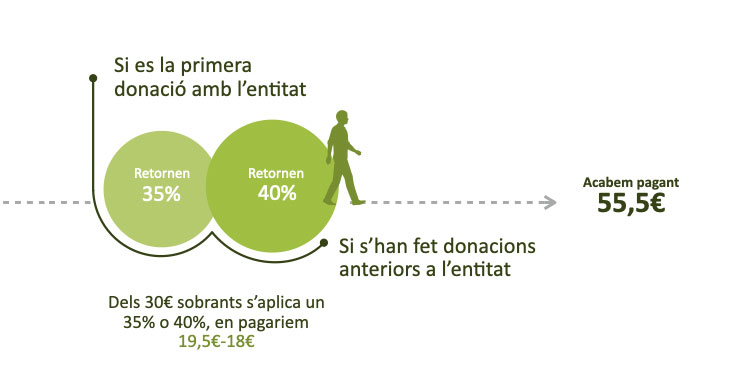

The new deduction percentage is 80% for donations of up to €150. If this amount is exceeded, the donor deducts the 35% from the excess amount. This means that whoever donates €100 can deduct a full share from their €80 declaration, so the real financial effort will be only €20. If you donate €200, the actual cost of your donation will be €72.50 (subtracting the €150 80% and the €50 surplus for the 35%). In addition, this percentage of the 35% on the surplus increases to 40% if in the two immediately preceding tax periods they have been given to the same entity for the same or higher amount, in each of them, than in the previous year.